IRON & STEEL

ALUMINUM

FERTILIZERS

HYDROGEN

CEMENT

ELECTRICITY

Take our short CBAM test and find out if and how this mechanism may affect your business!

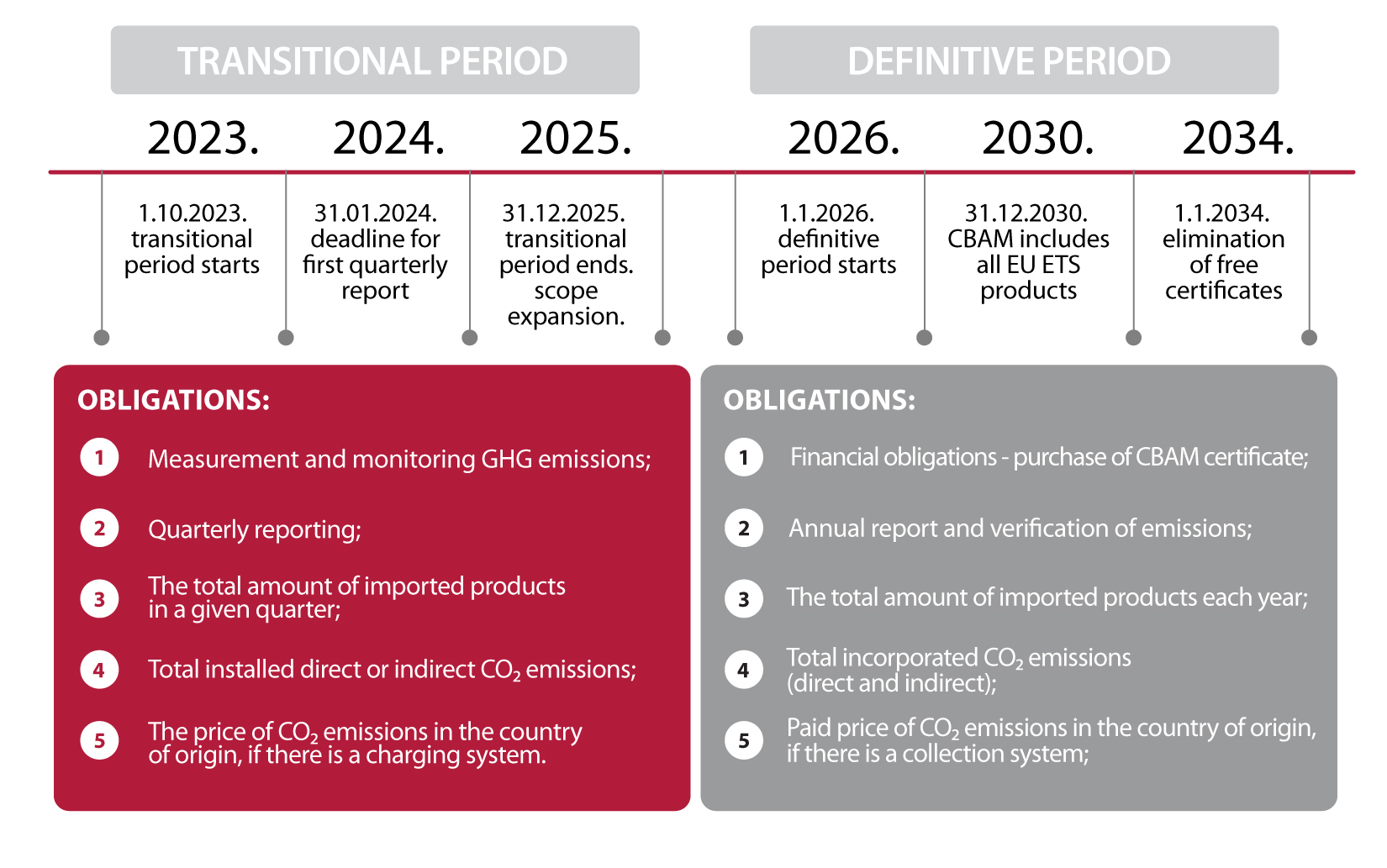

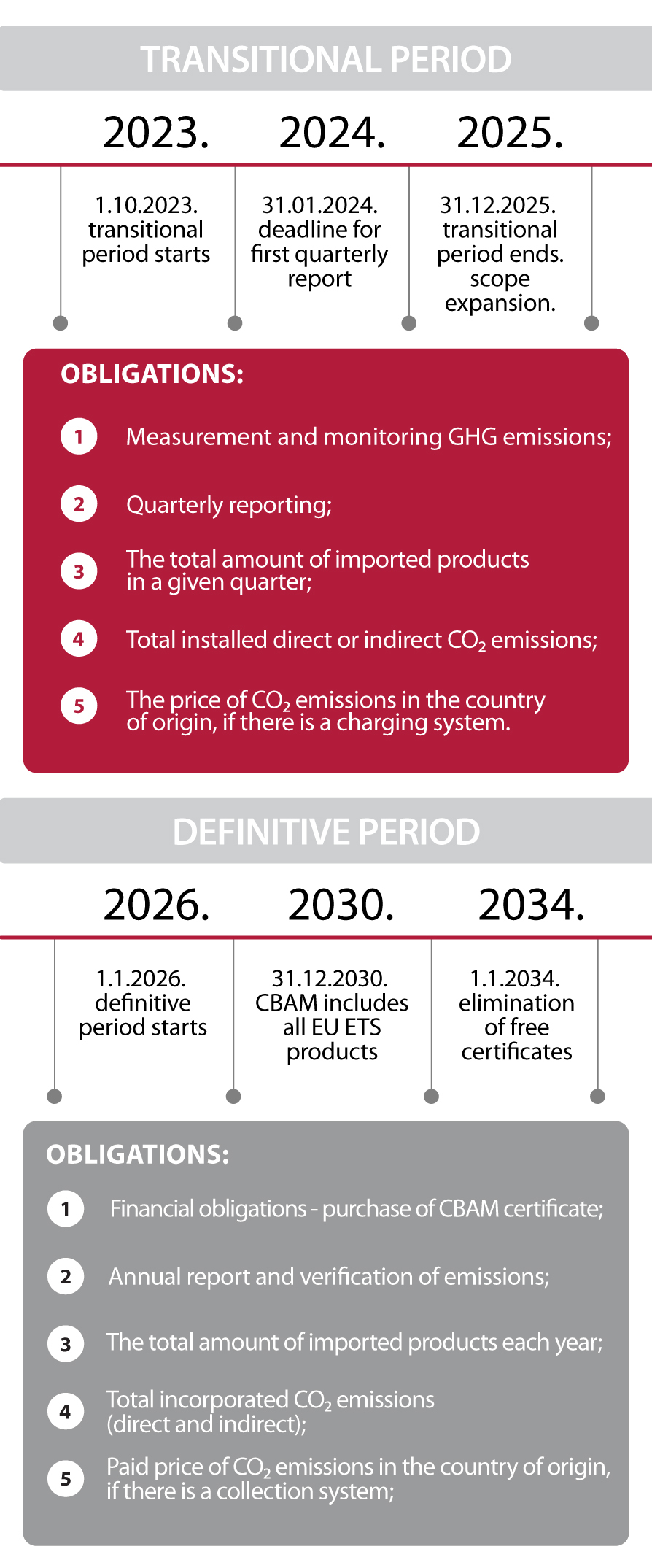

CBAM will be implemented in two stages. The CBAM has a transitional period that started on October 1, 2023, and runs until 31 December 2025. The purpose of the transitional phase is to provide a learning period for all stakeholders. During this phase, importers must only submit CBAM reports, with no financial adjustments necessary. Importers of CBAM goods must submit quarterly reports, which contain details on the quantity of goods imported, direct and indirect GHG emissions embedded in the products and any carbon price paid in the country of origin. There are, however, penalties for non-compliance. These may range between EUR 10 and 50 /t of unreported emissions. Penalties apply where the declarant has failed to submit a CBAM report or where it is incorrect or incomplete and has not been corrected after the competent authority initiated the correction procedure. CBAM reports need to be filed within a month after the end of the reporting quarter, with an additional month to correct any possible errors in the submitted report.

In its definitive phase, which starts on January 1, 2026, the obligation of CBAM reporting continues; only the reports will be submitted annually. Emissions verification requirements will also come into force in this period. However, the main change is that importers will be required to start purchasing and surrendering CBAM certificates. The number of CBAM certificates to be surrendered increases gradually with the reduction of free allocations according to the EU ETS. Starting in 2026, importers will be required to surrender CBAM certificates for 2.5% of embedded emissions for their CBAM products. This percentage will incrementally increase yearly until it reaches 100% in 2034, aligning with the anticipated elimination of free allocations in the EU ETS. The scope of CBAM products is expected to gradually completely align with the EU ETS by the end of 2030. Penalties for non-compliance will increase and may amount to EUR 100/t of undeclared emissions.

Are you ready for CBAM? To find out if CBAM applies to your business, click the link to take the test.

The Carbon Border Adjustment Mechanism (CBAM) is currently undergoing an intensive process of development and refinement by the European Commission to ensure its effective implementation. During the 2024–2025 period, key aspects of CBAM need to be addressed, including conditions for the sale and purchase of certificates, customs procedures, accreditation of verifiers, and adjustments related to the CBAM registry. The work plan also includes reporting on the impact of CBAM, its application to downstream products, as well as the overall improvement and enhancement of the mechanism. These activities are crucial to ensure that CBAM becomes fully operational for the Definitive Phase starting in 2026, when the payment obligations under this mechanism will also take effect.

On February 26, 2025, the European Commission unveiled a new legislative package aimed at simplifying sustainability and investment regulations. As part of its Competitiveness Compass, the Commission has outlined a strategy to enhance the EU’s economic prosperity and global competitiveness.

Known as Omnibus I and Omnibus II, these reforms are designed to reduce administrative burdens, enhance business competitiveness, and uphold the EU’s sustainability goals. By streamlining compliance, the EU hopes to make regulatory obligations more manageable while still upholding environmental and social governance (ESG) objectives.

Among the affected regulations, CBAM will undergo significant changes:

This simplification effort precedes a planned extension of CBAM to additional ETS sectors and downstream goods. A new legislative proposal on the scope expansion of CBAM is expected in early 2026.

What is the difference between simple and complex goods?

CBAM goods come in two types: simple and complex. Simple goods are made entirely from input materials with zero embedded emissions under CBAM’s reporting rules. This means their embedded emissions solely come from the production process itself. On the other hand, complex goods must also account for the embedded emissions of precursor materials used in their production—materials that are CBAM-regulated themselves. Relevant precursor materials refer to those raw materials used in the production of complex CBAM goods that are CBAM goods themselves.

What are direct and indirect emissions?

CBAM tracks two types of emissions:

During CBAM’s transitional phase, importers must report both types of emissions for all CBAM goods. However, from 1 January 2026, the scope narrows to direct emissions for iron, steel, aluminum, and hydrogen, while cement and fertilizer importers must still report both.

Who checks the accuracy of CBAM reports?

During the transitional period, the European Commission will be the first to review CBAM reports, flagging incomplete or questionable CBAM reports to national competent authorities (NCAs). NCAs then decide whether to investigate, correct, or penalize inaccuracies. Accuracy isn’t just a nice-to-have—it’s essential.

What is the process for accrediting verifiers?

The European Commission is crafting supplementary legislation during the transitional phase to guide verifier accreditation. National Accreditation Bodies (NABs) in EU Member States will handle this, aligning verification processes with CBAM and the EU ETS. However, full accreditation still awaits final legislative approval.

How are emissions determined for old stock?

For imports until 30 June 2024, embedded emissions for stock items could be estimated using default values provided by the European Commission. After that date, actual data must be reported. If old stock or spare parts lack data, you can use emission figures from similar or identical goods.

What are the penalties for non-compliance with CBAM?

Starting 1 October 2023, reporting embedded emissions is mandatory. Penalties range from €10 to €50 per tonne of unreported emissions. If reports are missing, incorrect, or incomplete, the NCAs may initiate a correction procedure granting reporting declarants the possibility to rectify potential errors. The NCA shall apply penalties where: a) the reporting declarant has not taken the necessary steps to comply with the obligation to submit a CBAM report, or b) where the CBAM report is incorrect or incomplete, and the reporting declarant has not taken the necessary steps to correct the CBAM report.

Gecić Law, widely recognized for its knowledge and experience in EU Law, international trade and competition matters, is proud to be one of the few law firms in the region with extensive experience advising the public and private sectors on the implications of CBAM and compliance with this groundbreaking regulation. For more information, please contact our legal team that will be pleased to provide further assistance.