It is common for the media to report on the incomes and prize money earned by professional athletes. However, what is less known are the intricacies of their tax obligations. Before delving into sports-related taxation, it’s essential to recognize that the contributions of professional athletes to their countries. These extend far beyond any monetary value that might arise from taxing their income and prize money. Nevertheless, taxes are an inevitable aspect of life, and the sports industry is no exception.

Taxing this revenue is always a hot topic, with sports becoming increasingly lucrative and generating substantial sums of money. Most countries, including Serbia, have specific regulations governing professional athletes’ income and prize money. It’s important to note that different tax treatments exist for athletes who have agreements with clubs in team sports (e.g., football, basketball) compared to those competing individually (e.g., tennis).

The Serbian Citizens Income Tax Act prescribes a specific tax form for the income of professional athletes and sports experts. Article 81 designates “Other” taxable income, including the income of professional athletes and sports experts, among other forms. Article 84a goes into more depth, describing the nature of this income.

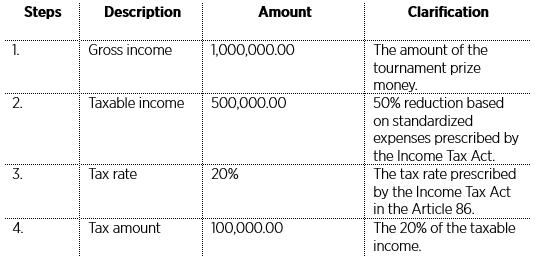

Taxable income represents gross income reduced by standardized expenses prescribed by the Act, amounting to 50%. Athletes do not have to prove the expenses incurred for competing and winning competitions due to standardized costs. However, there is no limitation by the 50% cap; athletes can demonstrate that their costs exceed 50% of the monetary portion of the prize money, thereby reducing their taxable income. The applicable tax rate for this form of tax is 20%.

The location of the tournament determines the tax jurisdiction over prize money.

Prize money an athlete earned in a tournament held within Serbia’s territory falls under its tax jurisdiction, regardless of whether the athlete is a resident. The Organizer of the competition is responsible for determining and paying this tax form on behalf of the athlete. The Organizer deducts the tax amount from the monetary part of the prize when transferring money to the athlete, ensuring the athlete receives the net amount that is not further taxable.

Professional athletes with agreements with clubs have a specific legal status, considered employment agreements in Serbia. Therefore, this income should be taxed under the same form as any employment relationship involving wages tax and social security contributions. The tax jurisdiction governing the territory where the professional club is based is applicable.

Most of the wealth of professional athletes often comes from sponsorships and endorsement deals. The athlete’s tax residency determines the tax jurisdiction over this income. In Serbia, tax residency is defined by two criteria imposed by the Income Tax Act.

Tax residency is assigned to a natural person who either has (i) residency or the center of business and life interest in the Republic of Serbia or (ii) continuously or intermittently stays in the Republic of Serbia for 183 days or more within 12 months that begins or ends in the respective tax year.

While tax residency is a prevailing criterion in determining the tax obligations of natural persons, some countries still use alternative criteria, such as citizenship.

Determining the tax obligations of professional athletes is a complex task, considering various factors like income sources, individual or team competition, and tax residency. While exploring these obligations is intriguing, it’s important to remember that the contributions of professional athletes to their home countries extend well beyond any potential revenue derived from their tax commitments.

Authors: Milica Novaković, Marko Jović