General Court brings the curtain down on epic court battle between Apple Ireland and the EU/European Commission in a state aid case labelled the ‘Apple Tax case’.

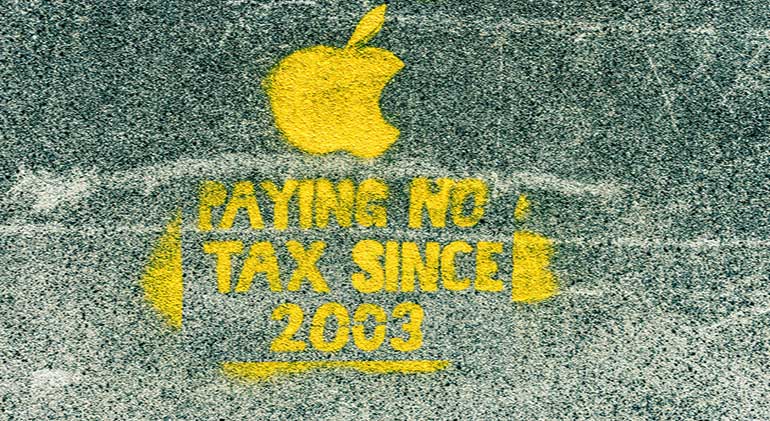

On July 15, 2020, the EU’s General Court overturned the Commission’s decision because the Commission failed to prove Apple had broken competition rules. Following an in-depth state aid investigation launched in June 2014, the Commission requested information on any rulings granted by Ireland in favour of the Apple Group companies: Apple Operations International (AOI), Apple Sales International (ASI) and Apple Operations Europe (AOE). The Commission concluded that two tax rulings issued by Ireland to Apple substantially and artificially lowered the tax paid by Apple in Ireland since 1991. In its order in 2016, the Commission claimed that Apple benefited from illegal state aid via two Irish tax rulings that artificially reduced its tax burden for over two decades – to as low as 0.005% in 2014 and that this constituted illegal aid given to Apple by Ireland. However, the Irish government argued that Apple should not have to repay the taxes, deeming that its loss was worth it to make the country an attractive home for large companies. Ireland, which boasts one of the lowest corporate tax rates in the EU, is Apple’s base for Europe, the Middle East and Africa. In short, the Commission underlined that, while Member States enjoy fiscal sovereignty, any tax measure adopted by a Member State must comply with EU state aid rules.

The General Court sided with a position of the Irish government saying that there was not enough evidence to demonstrate that Apple received preferential treatment. Some progressive governments may allow the wealthiest company in the world to avoid paying billions of euros in taxes under one condition – the legality of that advantage. The General Court argued that, as the Commission did not succeed in showing to the requisite legal standard that there was a selective advantage, the contested decision must be annulled in its entirety without it being necessary to examine the other pleas in law raised by Ireland, ASI and AOE, which is exactly what the Court did.

The General Court decision is another setback for the EU, which is leading a charge to to crack down on alleged tax avoidance. In a statement given on July 15, 2020 as regards the ‘Apple Tax case’ decision, the Commission’s representative, Executive Vice-President Margrethe Vestager claimed that “the Commission stands fully behind the objective that all companies should pay their fair share of tax. If Member States give certain multinational companies tax advantages not available to their rivals, this harms fair competition in the EU. It also deprives the public purse and citizens of funds for much needed investments – the need for which is even more acute during times of crisis”.

The Commission has the right to appeal the decision to Europe’s highest court, the European Court of Justice, so if Vice-President put forth that “We will carefully study the judgement and reflect on possible next steps”, we are eager to see what happens next and if you are too, stay tuned to Gecic Law.

Authors: Nađa Kosić i Jovana Trivunović